Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

Strategic analysis refers to the process of conducting research on a company and its operating environment to formulate a strategy. The definition of strategic analysis may differ from an academic or business perspective, but the process involves several common factors:

A strategy is a plan of actions taken by managers to achieve the company’s overall goal and other subsidiary goals. It often determines the success of a company. In strategy, a company is essentially asking itself, “Where do you want to play and how are you going to win?” The following guide gives a high-level overview of business strategy, its implementation, and the processes that lead to business success.

To develop a business strategy, a company needs a very well-defined understanding of what it is and what it represents. Strategists need to look at the following:

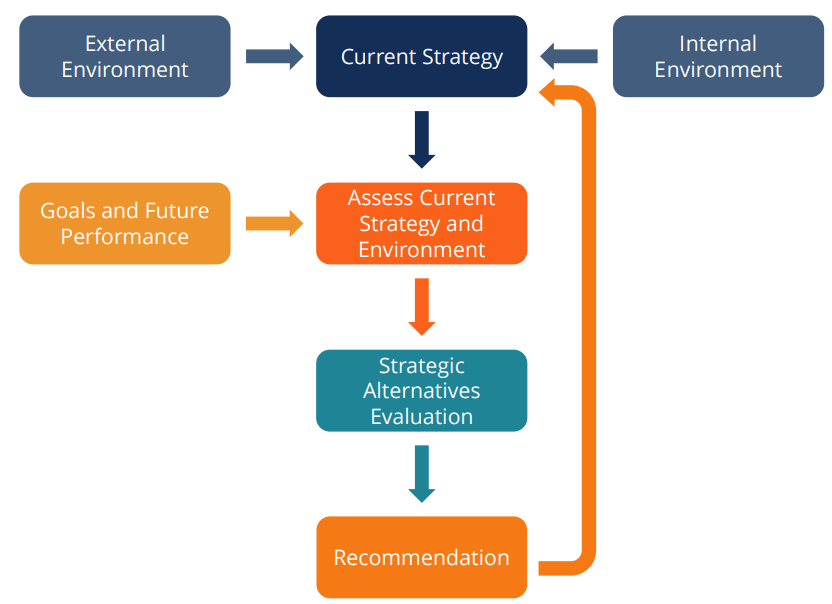

After gaining a deep understanding of the company’s vision, mission, and values, strategists can help the business undergo a strategic analysis. The purpose of a strategic analysis is to analyze an organization’s external and internal environment, assess current strategies, and generate and evaluate the most successful strategic alternatives.

The following infographic demonstrates the strategic analysis process:

Starting from the beginning, a company needs to complete an environmental analysis of its current strategies. Internal environment considerations include issues such as operational inefficiencies, employee morale, and constraints from financial issues. External environment considerations include political trends, economic shifts, and changes in consumer tastes.

A key purpose of a strategic analysis is to determine the effectiveness of the current strategy amid the prevailing business environment. Strategists must ask themselves questions such as: Is our strategy failing or succeeding? Will we meet our stated goals? Does our strategy align with our vision, mission, and values?

If the answer to the questions posed in the assessment stage is “No” or “Unsure,” we undergo a planning stage where the company proposes strategic alternatives. Strategists may propose ways to keep costs low and operations leaner. Potential strategic alternatives include changes in capital structure, changes in supply chain management, or any other alternative to a business process.

Lastly, after assessing strategies and proposing alternatives, we reach a recommendation. After assessing all possible strategic alternatives, we choose to implement the most viable and quantitatively profitable strategy. After producing a recommendation, we iteratively repeat the entire process. Strategies must be implemented, assessed, and re-assessed. They must change because business environments are not static.

Strategic plans involve three levels in terms of scope:

At the highest level, corporate strategy involves high-level strategic decisions that will help a company sustain a competitive advantage and remain profitable in the foreseeable future. Corporate-level decisions are all-encompassing of a company.

At the median level of strategy are business-level decisions. The business-level strategy focuses on market position to help the company gain a competitive advantage in its own industry or other industries.

At the lowest level are functional-level decisions. They focus on activities within and between different functions, aimed at improving the efficiency of the overall business. These strategies are focused on particular functions and groups.

Thank you for reading CFI’s guide to Strategic Analysis. To keep learning and advancing your career, the following CFI resources will be helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.